Assumption: The appraised value of a property will vary, depending upon whether the appraisal is conducted for the buyer or the seller.

Fact: Our appraisers have no vested interest in the outcome of the appraisal and will render services with independence, objectivity and impartiality, and value considerations should be similar whether they are done for the buyer or the seller.

Assumption: Appraisers are hired only to estimate real estate property values in property sales involving mortgage-lending transactions.

Fact: Depending upon their qualifications and designations, appraisers can and do provide a variety of services, including advice for estate planning, dispute resolution, zoning and tax assessment review and cost/benefit analysis. At PF Kruse our staff consists of appraisers qualified to handle all of these services.

Assumption: Market value should approximate replacement cost.

Fact: Market value is based on what a willing buyer likely would pay a willing seller for a particular property, with neither being under pressure to buy or sell. Replacement cost is the dollar amount required to reconstruct a property in-kind.

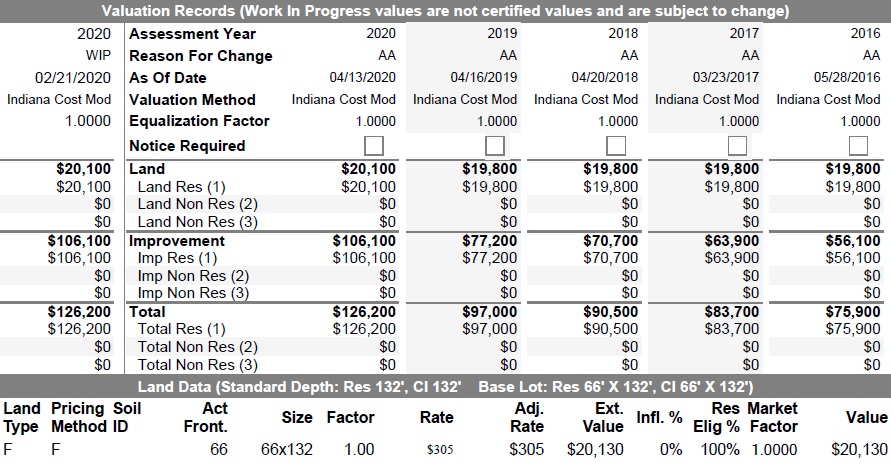

Assumption: Assessed value should equate to market value.

Fact: While most states support the concept that assessed value approximate estimated market value, this often is not the case. Examples include when interior remodeling has occurred and the assessor is unaware of the improvements, or when properties in the vicinity have not been reassessed for an extended period. Homeowners should keep in mind assessed value is still based on a complex formula that includes sales prices, as well as state provided cost manuals, not just on actual sales prices of the home or the neighborhood. PF Kruse can, and has, prepared appraisals specifically to appeal the assessed value of a home. Keep in mind, that in the state of Indiana, if the assessed value is within 10 percent of the appraised value, the assessment does not have to be changed.

Assumption: Appraisers use a formula, such as a specific price per square foot or lake frontage feet, to figure out the value of a home.

Fact: Appraisers make a detailed analysis of all factors pertaining to the value of a home including its location, condition, size, proximity to facilities or amenities and recent sale prices of comparable properties in the subject market area. Lake property also has many more variables to value than just the amount of lake frontage including location on the lake, view, beach type, overall lot size, elevation, slope and overall terrain.

Assumption: Because consumers pay for appraisals when applying for loans to purchase or refinance real estate, they own their appraisal.

Fact: The appraisal is, in fact, legally owned by the lender who ordered the appraisal – unless the lender “releases its interest” in the document. However, consumers may obtain a copy of the appraisal report from their lender who ordered the report under the Equal Credit Opportunity Act.

Assumption: In a robust or declining economy – when the sales prices of homes in a given area are reported to be rising of falling by a particular percentage – the value of individual properties in the area can be expected to appreciate or depreciate by that same percentage.

Fact: Value appreciation of a specific property must be determined on an individualized basis, factoring in data on comparable properties and other relevant considerations. This is true in good times as well as bad. The appraised value of your home could go up or down in any three to twelve month period based on sales of similar type properties in your area. Also, keep in mind an overall reported state or county trend may or may not apply to a specific neighborhood or market area. Every location is unique and it is possible for a lake market or a specific subdivision to see increases in value at the same time values may be falling in other areas, or visa versa.

Assumption: An Appraisal is the same as a home inspection.

Fact: An appraisal does not serve the same purpose as a home inspection. The appraiser forms an opinion of value in the appraisal process and resulting report, and typically assumes that mechanical systems, structural integrity, roofing or other building components are in average condition. A home inspector is needed to determine the condition of the home and these major components and reports these findings. PF Kruse does not do home inspections and no appraisal report should be confused with a home inspection. Problems or issues unknown to the appraiser may have a negative affect on value. When one of our appraisers comes to your property it is considered an observation to determine value, not an inspection of the condition of your house. Home inspections must be done by a state licensed home inspector.

Real Estate Appraisal

Assumption: Consumers need not be concerned with what is in the appraisal document so long as it satisfies the needs of their lending institution.

Fact: Only if consumers read a copy of their appraisal can they double-check its accuracy and question the result. Also, it makes a valuable record for future reference, containing useful and often-revealing information – including the legal and physical description of the property, square footage measurements, list of comparable properties in the neighborhood, neighborhood description and a narrative of current real-estate activity and/or market trends in the vicinity.

Assumption: You generally can tell what a property is worth simply by looking at the outside.

Fact: Property value is determined by a number of factors, including location, interior and exterior condition, improvements, amenities, and market trends. It may be possible to determine on overall average value of a neighborhood, but it is difficult to get an accurate opinion of value without being able to see the interior of a property, as the exterior may not be a true reflection of what is inside. Exterior appraisals of property are often utilized by lenders and appraisers, but assumptions about the interior will have to be made, which may make them less accurate than an interior inspections.