What is an appraisal? What goes into a real estate appraisal?

It starts with an evaluation. An appraiser’s duty is to inspect the property being appraised to ascertain the true status of that property. The appraiser must actually see a property’s neighborhood and features, such as the number of bedrooms, bathrooms, living area, and so on, to ensure that they really exist and are in the condition a reasonable buyer would expect them to be. The home evaluation includes a sketch of the property, ensuring the proper square footage and conveying the layout of the property. The inspection the appraiser does should not be confused with a home inspection. The appraiser is viewing the entire home and its overall condition to establish an estimate of value and not to determine if everything is in working order. An actual home inspection by a licensed home inspector is needed to determine if the property is sound and if all mechanicals are working property. The appraiser does look for any obvious features – or defects – especially those that would affect the value of the house. Once the site has been researched or viewed, an appraiser uses one, two or three approaches to determining the value of real property: a cost approach, a sales comparison or, in the case of rental type property, an income approach.

Cost Approach

The cost approach is the easiest to understand. The appraiser uses information on local building costs, labor rates and other factors to determine how much it would cost to construct a property similar to the one being appraised. This cost of construction is then depreciated based on the improvements age and condition. This value is then added onto the value of the land, without improvements. The cost approach to value often sets the upper limit on what a property would sell for. Why would you pay more for an existing property if you could spend less and build a brand new house instead? While there may be mitigating factors, such as location and amenities, these are usually not reflected in the cost approach.

Sales Comparison Approach

Appraisers rely on the sales comparison approach to value. Our appraisers know the neighborhoods in which they work. They understand the value of certain features to the residents of that area. They know traffic areas, school districts, and lake differences; they use this information to determine which attributes of a property will make a difference in value. The appraiser researches recent sales in the vicinity and finds properties similar to the one being appraised. The sales prices of these properties are used as a basis to begin the sales comparison approach. Using knowledge of the value of items such as square footage, recent remodeling, extra bathrooms, hardwood floors, fireplaces or lot views (just to name a few), the appraiser adjusts the comparable properties to more accurately portray the subject property. For example, if the comparable property has a fireplace and the subject does not, the appraiser may deduct the value of a fireplace from the sales price of the comparable home. If the subject property has an extra half-bathroom and the comparable does not, the appraiser might add a certain amount to the comparable property. After making adjustments to properties that are similar to the subject, a range of value is developed.

Income Approach

In the case of income producing properties – rental houses for example – the appraiser may use a third approach to valuing the property. In this case, the amount of income the property produces is used to arrive at the current value of those revenues over the foreseeable future.

Reconciliation

Depending on the type of appraisal, the appraiser combines information from the approaches used and estimates the market value for the property. It is important to note that while this amount is probably the best indication of what a property is worth, it may not be the final sales price. There are always mitigating factors such as seller motivation, urgency or ”bidding wars” that may adjust the final price up or down. But the appraised value is often used as a guideline for lenders who don’t want to loan a buyer more money that the property is actually worth. An appraiser will help you determine the most accurate property value, allowing you to make the most informed real estate decision possible.

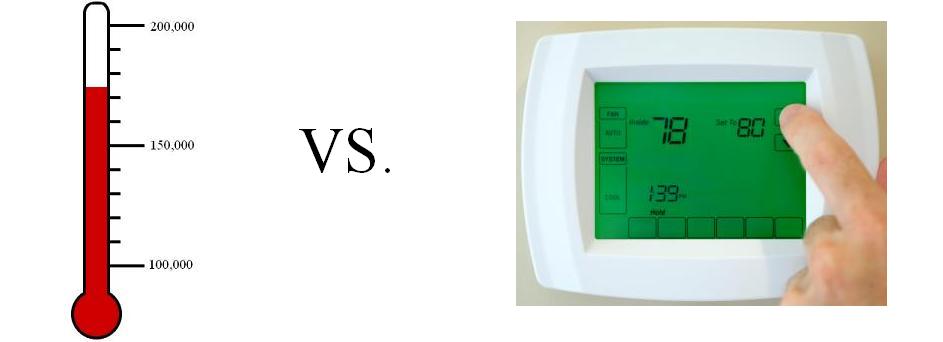

Appraisers Report Values – They Do Not Set Values

Appraisers are like thermometers – they report the current temperature of the market. They are not thermostats – who set prices or values in the market. While one thermometer may differ one or two degrees from another one, a properly functioning thermometer is designed to give the true temperature. This should be the case for appraisers as well, while one may come out with a slightly different value than another, they should still be fairly close as their values should be a reflection of the market. Honest and ethical appraisers cannot decide they want a property to be worth more or less than what the market says. They cannot change their values to meet what someone else says a property is worth, or hit a specific number. Only the market can determine where values are at on the day the appraiser values the property. Many times when a real estate transaction falls through, people want to blame the appraiser for coming in with a low value. The opposite should be true, as appraiser’s are trying to protect everyone’s best interests by letting them know current conditions in the market. In a paraphrase taken from a television show, Appraisers are just weather vanes; they can’t make the wind blow.